Yields Surge After Treasury Boosts Auction Sizes More Than Expected, Sees Debt Issuance Tsunami On Deck

The table below presents, in billions of dollars, the actual auction sizes for the May to July 2023 quarter and the anticipated auction sizes for the August to October 2023 quarter

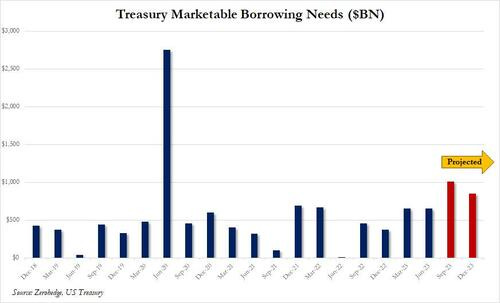

We gave a big picture preview of the debt flood (and fiscal crisis) that is coming to the US this past Monday when, looking at the latest Treasury debt estimates, we showed that the US predicted a near-record $1 trillion in debt sales in the current quarter (up from $$733BN forecast previously) and $852 billion in Oct-Dec quarter, numbers so staggering they are usually associated with economic crises...

... but in this case a surge in debt issuance meant to sustain the illusion of the deficit-busting Bidenomics, which has managed to keep the US economy from imploding only thanks to massive new debt and deficit spending, or what BofA's Michael Hartnett called "The Era Of Fiscal Excess", something which Fitch finally realized last on Tuesday when it became only the second rating agency in history to downgrade the US AAA rating.

.. this morning we got a more granular preview of how we get there, when the Treasury published its quarter refunding statement, in which the US boosted the size of its quarterly sale of longer-term debt for the first time in over 2 1/2 years, testing buyers' appetites amid an increase in government borrowing needs so alarming it helped spur Fitch Ratings to cut the US sovereign rating from AAA (and judging by the surge in yields this morning, the appetite may be lacking).

The Treasury said it will sell $103 billion of longer-term securities at its so-called quarterly refunding auctions next week, which span 3-, 10- and 30-year Treasuries, and will refund approximately $84 billion of maturing Treasury notes and bonds, raising about $19 billion in new cash. That’s a big jump from a $96 billion in gross issuance last quarter, and larger than most dealers had expected.

Specifically, for next week’s refunding auctions, they break down as follows:

$42 billion of 3-year notes on Aug. 8, up from $40 billion at the May refunding and at the last auction in July

$38 billion of 10-year notes on Aug. 9, compared with $35 billion last quarter

$23 billion of 30-year bonds on Aug. 10, versus $21 billion in May

Issuance plans for TIPS, were held steady except for the 5-year maturity, where October’s new-issue auction will go up by $1 billion. Floating-rate note auction sizes were increased by $2 billion.

The table below presents, in billions of dollars, the actual auction sizes for the May to July 2023 quarter and the anticipated auction sizes for the August to October 2023 quarter:

Go paid at the $5 a month level, and we will send you both the PDF and e-Pub versions of “Government” - The Biggest Scam in History… Exposed! and a coupon code for 10% off anything in the Government-Scam.com/Store.

Go paid at the $50 a year level, and we will send you a free paperback edition of Etienne’s book “Government” - The Biggest Scam in History… Exposed! AND a 64GB Liberator flash drive if you live in the US. If you are international, we will give you a $10 credit towards shipping if you agree to pay the remainder.

Support us at the $250 Founding Member Level and get a signed high-resolution hardcover of “Government” + Liberator flash drive + Larken Rose’s The Most Dangerous Superstition + Art of Liberty Foundation Stickers delivered anywhere in the world. Our only option for signed copies besides catching Etienne @ an event.