Gold Spikes To Record High Over $2,130, Bitcoin Soars Above $40,000 As Market Calls Powell's Bluff

Well, with futures having opened for trading on Sunday night, what we joked about on Friday, namely that Powell - having seemingly once again lost control of the hawkish narrative

On Friday, shortly after Powell failed to hammer the hawkish case in his "fireside" chat with stocks eager to take out 2023 highs, we said that Powell has a big problem on his hands not so much because if the market was indeed correct about imminent easing that only assures that inflation will come back with a vengeance and Powell would indeed be the "second coming" of a former Fed Chair - only Burns not Vlcker - but because the kneejerk surge higher in gold (and digital gold) meant that the once again deathwatch for the dollar - and fiat in general - had resumed.

Well, with futures having opened for trading on Sunday night, what we joked about on Friday, namely that Powell - having seemingly once again lost control of the hawkish narrative - may be leaking emergency rate hikes though Nick Timiraos on Dec 12, ahead of the December FOMC (now that the Fed is in blackout mode)...

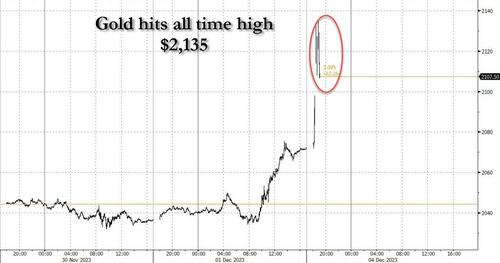

... is all too real because suddenly everything that is non printable is soaring, starting with gold, which has exploded as much as $60, spiking to a new all time high of $2,135...

The bitcoin move was to be expected after what we reported yesterday, namely that cryptos had just seen their largest inflows in two years... and Friday's comments by Powell only guaranteed even more capital would flow into the largely illiquid asset class.

"Bitcoin continues to be supported by optimism around SEC approval for an ETF and Fed rate cuts in 2024,” Tony Sycamore, a market analyst at IG Australia Pty, wrote in a note. Technical chart patterns point to $42,330 as the next level to watch for, he added.

As for gold, everything is suddenly going in its favor, and not only the violent resumption of the Israel-Hamas war (which now includes attacks on US warships in the Gulf)...

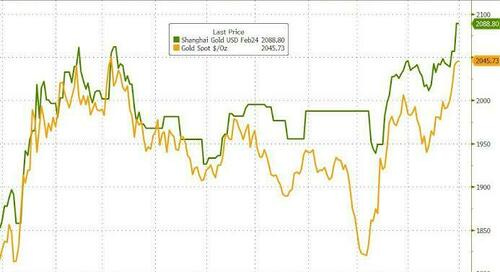

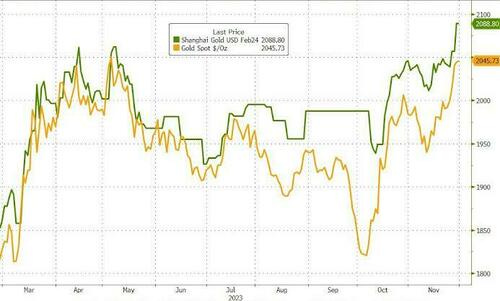

... as well as the relentless buying out of China which we discussed last week in "Behind The Mysterious Explosion In Gold Prices: China's "Massive Accumulation Of Gold" which noted the staggering divergence between Shanghai and London gold prices, a clear proxy for outsized demand for physical gold on the mainland...

... but also years of market reflexes which prompt algos to buy gold any time the Fed is set to ease, something which markets assigned 80% odds on Friday could happen as soon as March.

And so, going back to square one, Powell is once again boxed in: either he pushes back on the market's sudden dovish euphoria which could well send dollar sparling lower, and in turn send commodities exploding higher guaranteeing that all the worst aspects of Burns Fed make a triumphant return, or he does nothing, and we see gold go parabolic.

Go paid at the $5 a month level, and we will send you both the PDF and e-Pub versions of “Government” - The Biggest Scam in History… Exposed! and a coupon code for 10% off anything in the Government-Scam.com/Store.

Go paid at the $50 a year level, and we will send you a free paperback edition of Etienne’s book “Government” - The Biggest Scam in History… Exposed! AND a 64GB Liberator flash drive if you live in the US. If you are international, we will give you a $10 credit towards shipping if you agree to pay the remainder.

Support us at the $250 Founding Member Level and get a signed high-resolution hardcover of “Government” + Liberator flash drive + Larken Rose’s The Most Dangerous Superstition + Art of Liberty Foundation Stickers delivered anywhere in the world. Our only option for signed copies besides catching Etienne @ an event.

Should have bought more gold and bitcoin.

Dammit.

You may have jumped the gun on publishing this article. Gold is down $94.67 at this moment. I'm guessing, hoping, it's just the power players manipulating the market as usual.