Fed Report: Largest 25 U.S. Banks Have Shed $700 Billion in Deposits Over Past Year

To read the headlines in the major business press, one would think that since the upheaval began in the U.S. banking system, the largest U.S. commercial banks have been the beneficiaries in terms...

To read the headlines in the major business press, one would think that since the upheaval began in the U.S. banking system, the largest U.S. commercial banks have been the beneficiaries in terms of deposit inflows. For example, on March 13 the Financial Times ran this headline: “Large US banks inundated with new depositors as smaller lenders face turmoil.” The subhead was even more questionable, reading: “Failure of Silicon Valley Bank prompts flight to likes of JPMorgan and Citi.” (JPMorgan Chase has been charged with five felony counts by the U.S. Department of Justice over the past nine years while Citigroup’s stock has been a basket case since the financial collapse in 2008. Citi did a 1-for-10 reverse stock split in 2011 to window dress its stock price.) See Citigroup stock price chart below.

On March 25, CNBC ran a similar article about deposit inflows to the big banks. Its first paragraph read as follows:

“The surge of deposits moving from smaller banks to big institutions including JPMorgan Chase and Wells Fargo amid fears over the stability of regional lenders has slowed to a trickle in recent days, CNBC has learned.”

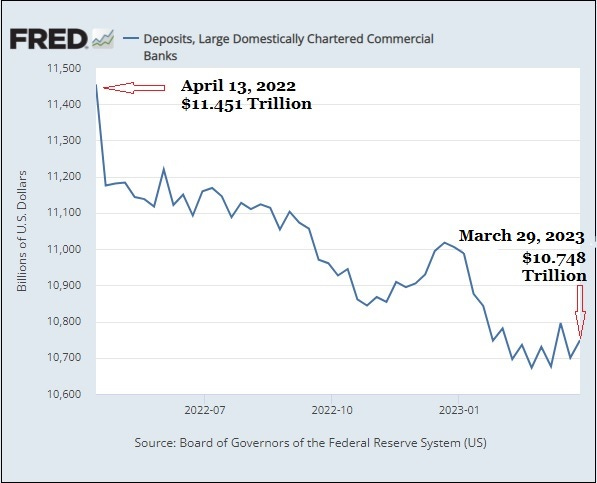

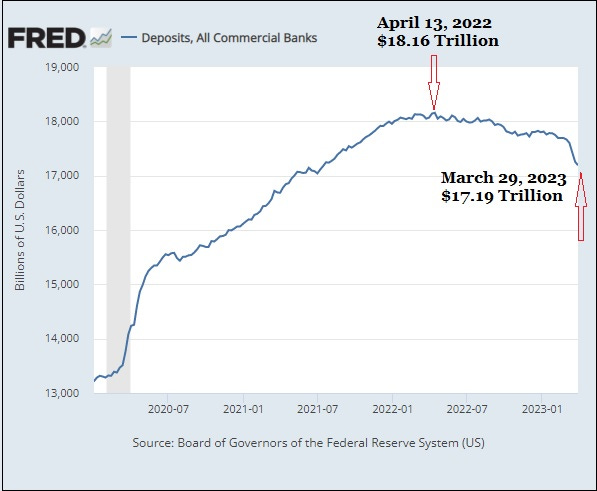

The reality is that the 25 largest domestically-chartered commercial banks in the U.S. have been bleeding deposits for most of the past 12 months, shedding more than $700 billion in deposits between April 13, 2022 and March 29, 2023. To put that in even sharper focus, all U.S. domestically-chartered commercial banks have lost a total of $970 billion during the same time period. That means that the largest 25 banks account for a whopping 72 percent of the plunge in deposits over the past year. (See chart below.)

Each Friday, at approximately 4:15 p.m., the Federal Reserve (the Fed) releases its H.8 report showing the assets and liabilities of commercial banks in the United States. That data includes deposits. The Fed’s H.8 data for all of these weekly releases going back to 1996 is available here. Equally helpful, the folks at the St. Louis Fed make it possible to chart much of that data via its FRED charting tools. (See, for example, the charts above.) We mention this because every American may need to become an expert on the U.S. banking system in order to separate fact from fiction and have confidence in where they are placing their bank deposits.

You may be thinking, should we really have confidence in numbers coming out of the Fed, which has so frequently been compromised by the mega banks on Wall Street. To be certain of the accuracy of our information, we cross-checked the deposit information with data at the Federal Deposit Insurance Corporation (FDIC).

Indeed, there was a blip in inflows of deposits to the largest U.S. commercial banks between March 8, 2023 and March 15, 2023. During that week, deposits to the 25 largest U.S. commercial banks increased from $10.67 trillion to $10.74 trillion or approximately $70 billion. But that small blip in inflows was quickly reversed. (See chart at the top of the page.)

What’s happening with the mega banks on Wall Street – all of which own trading casinos as well as federally-insured banks – will come under close scrutiny beginning this Friday. JPMorgan Chase, Citigroup and Wells Fargo are scheduled to report their earnings for the first quarter on Friday, April 14. Bank of America is scheduled to report earnings for the same period next Tuesday, April 18. Goldman Sachs will also report earnings on Tuesday, April 18. (Given Goldman’s struggles in the last quarter of 2022, its earnings for the first quarter of this year are certain to be closely scrutinized.) Goldman’s peer bank, Morgan Stanley, will report on Wednesday, April 19.

Go paid at the $5 a month level, and we will send you both the PDF and e-Pub versions of “Government” - The Biggest Scam in History… Exposed! and a coupon code for 10% off anything in the Government-Scam.com/Store.

Go paid at the $50 a year level, and we will send you a free paperback edition of Etienne’s book “Government” - The Biggest Scam in History… Exposed! AND a 64GB Liberator flash drive if you live in the US. If you are international, we will give you a $10 credit towards shipping if you agree to pay the remainder.

Support us at the $250 Founding Member Level and get an Everything Bundle – The Sampler of Liberty! - Get it free by going paid as a Founding Member!

Give me Liberty... and give me more! The Everything Bundle includes the latest version of our flagship book on government, along with a collection of potentially life-altering introductions to voluntaryism, agorism and peaceful anarchy.

“Government” – The Biggest Scam in History… Exposed! by Etienne de la Boetie2

Anarchy Exposed! - A former police officer reports on his investigative journeyby Shepard the Voluntaryist and Larken Rose

The Most Dangerous Superstition by Larken Rose

Sedition, Subversion and Sabotage – Field Manual #1 by Ben Stone, The Bad Quaker, and Ken Yamarashi

What Anarchy Isn’t– A short pamphlet by Larken Rose… The perfect introduction to peaceful anarchy

Three Friends Free – A Children’s Story of Voluntaryism

The Liberator is a 64GB wafer flash drive filled with books, documentaries, podcasts, MP3s, short videos, and music from the truth movement’s leading artists. The credit card-sized format makes it convenient to keep in your wallet to share and copy easily.